“Real estate is an important alternative in investment portfolios. The types of assets are multiple and the levels of risk offered are different, including the risks associated with potential means of investment: Inflation rates / Credit / currency … “

An important investment element in the alternative field is real estate, and despite the sentiment of many investors that investing in real estate is relatively “simple,” it is actually a very complex investment area.

The real estate market includes many types of properties – offices, shopping centers, retail centers, infrastructure, industries, nursing homes, agricultural land, buildable land …

They are also divided into different types of assets, according to risk levels and the nature of the investment. This includes various types of real estate in different geographical areas with potential for different chances and risks; most capable investors primarily invest in investment apartments.

The Israeli market is flooded with various investment proposals in real estate

Local real estate (plots, offices, residences, etc.), in this article, we will try to differentiate between types of assets and levels of risk – the chances of various types of investment in real estate, and present some of the risks that accompany this investment and some of the possible investment methods today.

All potential investment sectors are spread across various geographical areas, different fields of activity, and “RMOT maturity” Divers -. “Core Value Add” and “Industrial Real Estate,” which is also divided into risk-chance levels:

Core Assets – Well defined as a “property” (relatively new, in a good location), complete or close to full occupancy (95% -100%) and leased to “good” tenants for long periods.

A core asset is a safe investment asset, and most returns will be relatively low (the purchase price will be high). For example, a new apartment in Tel Aviv that is rented to a good long-term tenant can be considered a core property.

Value Add Assets – generally properties that can bring about changes that will lead to an increase in value, such as an increase in occupancy rate (80% or more), utilizing additional building rights, changing zoning for commercial office space, raising rent or extending leases, or any other change we identify that can lead to additional value for the asset.

The risk-chance equation is different here, as the buyer of the asset assumes a certain risk that the “value add” process may fail. An apartment rented in Tel Aviv, but a candidate for TAMA 38 and expansion, can be considered a value add asset.

Opportunistic Assets – A variety of entrepreneurial assets in which significant value can be generated through major initiatives, such as demolition and reconstruction, acquisition and construction of land, changing the designation of land or residential buildings, etc. These assets are relatively “cheap,” but the risk is relatively high since the entrepreneurial risk is high in this case. A plot where you can build several housing units can be an opportunistic asset.

The main divisions are based on the intended use of the property: residential real estate, industry, commerce, offices, agriculture, logistics, and more.

Exposures and risks related to investing in real estate

Investing in real estate involves different types of exposures and risks, such as location risks, planning, leverage, risks related to macroeconomic and microeconomic conditions, legal risks, and regulatory risks.

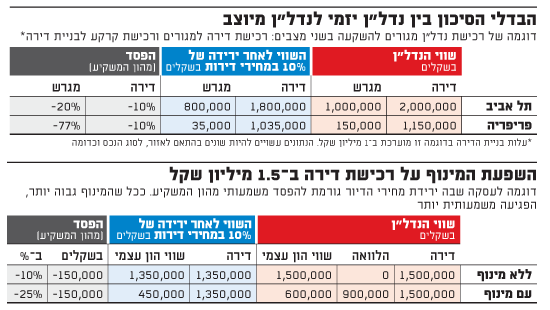

Example of realization of regulatory risk: the Israeli government’s efforts to lower prices expose the residential real estate investor to various risks (for example, the “Third Apartment” law which would reduce the attractiveness of investments in residential real estate or the “occupants’ price” plan which damages the value of land not belonging to this plan).

The real estate sector is one of the most complex investment areas for a single qualified client, the high amount required, the need to diversify the investment, the ability to examine different types of placements, and identify the various risks specific to the transaction.

More than in other areas. It is true to diversify investments in real estate, but no less than that, be cautious.

[fusion_button link=”https://fr.isra.land/get-quote/” text_transform=”” title=”” target=”_self” link_attributes=”” alignment=”” modal=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” color=”default” button_gradient_top_color=”” button_gradient_bottom_color=”” button_gradient_top_color_hover=”” button_gradient_bottom_color_hover=”” accent_color=”” accent_hover_color=”” type=”” bevel_color=”” border_width=”” size=”” stretch=”default” shape=”” icon=”” icon_position=”left” icon_divider=”no” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]Request advice [/fusion_button]

The Israland advice: Diversifying investments in real estate in a country like Israel, which is achieving construction rates that would make European countries pale, is the best way to hope for significant returns in the coming years.

We made the choice in 2013 to focus solely on the land of Israel, given that everything starts there, and considering the pace of urban developments that show no signs of slowing down, the vision is simple: One day, a construction will rise on our soil and no matter what price we receive in exchange for our land, it will be much higher than 20 years of rent received from an apartment.

The tax reforms in real estate have supported our choice, as they do not apply to landowners in Israel; an average individual can acquire an unlimited number of plots without including them in their taxable estate.

[fusion_button link=”https://fr.isra.land/get-quote/” text_transform=”” title=”” target=”_self” link_attributes=”” alignment=”” modal=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” color=”default” button_gradient_top_color=”” button_gradient_bottom_color=”” button_gradient_top_color_hover=”” button_gradient_bottom_color_hover=”” accent_color=”” accent_hover_color=”” type=”” bevel_color=”” border_width=”” size=”” stretch=”default” shape=”” icon=”” icon_position=”left” icon_divider=”no” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]Get advice [/fusion_button]

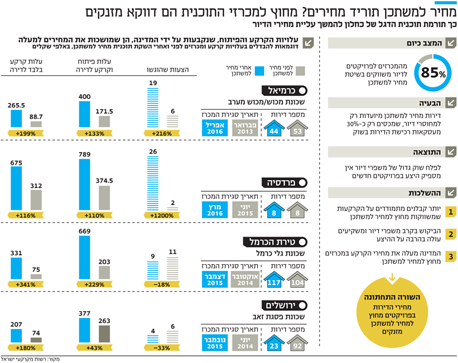

Regions that are now known as “the cheapest in Israel” are becoming increasingly rare; it is advisable to take seriously the evolution of these areas and to invest in them very quickly! Israelis are finding alternatives to housing, and the solution is coming fast: The country being relatively small, if transport routes and access are easy and quick, then the populations (which are excelling every year) will return to the peripheries.

For this, Israel is working on it and the result is expected for 2019:

Train that will traverse and serve the entire country.

New roads

New public transport routes

New tunnels

New internal airports

New seaports

New “Hub” transport in the metropolises.